Do Consumers Seek More Credit After Their Score Recovers?

Blog: Enterprise Decision Management Blog

In a previous post, we noted that the majority of consumers who had a 7-year-old delinquency purged from their credit file saw improvements in their FICO® Scores. Now let’s look at whether these consumers’ credit-seeking behavior changed after the delinquency was purged and their score recovered. Were they more likely to apply for credit? Get approved and open new accounts?

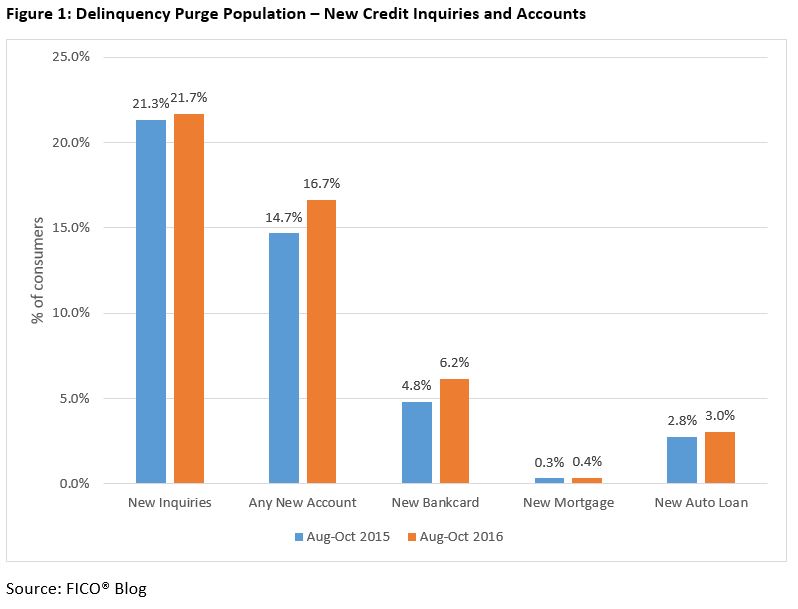

To assess this, we looked at the proportion of the “delinquency purge” population (those that had a delinquency removed from their credit report between May 2016 and July 2016) that had a new inquiry or opened a new account in the three months following the purge window (August through October 2016).

In Figure 1, we compared those values to the same period a year earlier, to avoid capturing seasonal changes in credit habits.

The data showed that there was a minor increase in the percentage of consumers that had a new inquiry compared to a year prior, and a material increase in those that opened a new account. This is particularly noticeable for new bankcards.

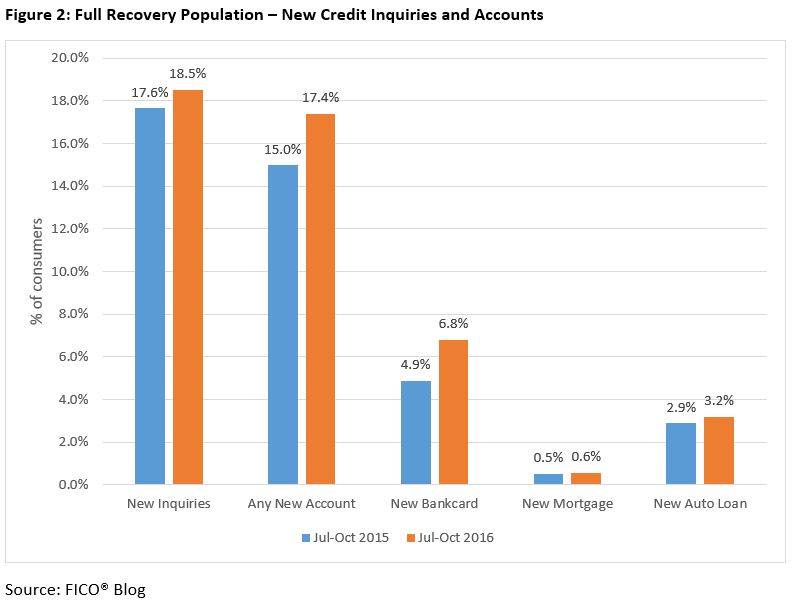

For the “full recovery” population (those in the “delinquency purge” population who had no remaining serious delinquencies), the changes were slightly more pronounced, as seen in Figure 2.

We see a greater increase in both new inquiries and account openings for this segment than is observed in the broader “delinquency purge” population. Furthermore, we see higher rates of new account openings despite lower rates of inquiries than the “delinquency purge” population, suggesting a higher approval rate.

This supports the idea that these consumers, who have rebuilt their credit profile and FICO® Score through years of responsible behavior, are now very well-positioned to access new credit at more favorable terms than they would have been offered before (which in turn may induce them to take on new credit).

Is It the Score or the Lending Environment?

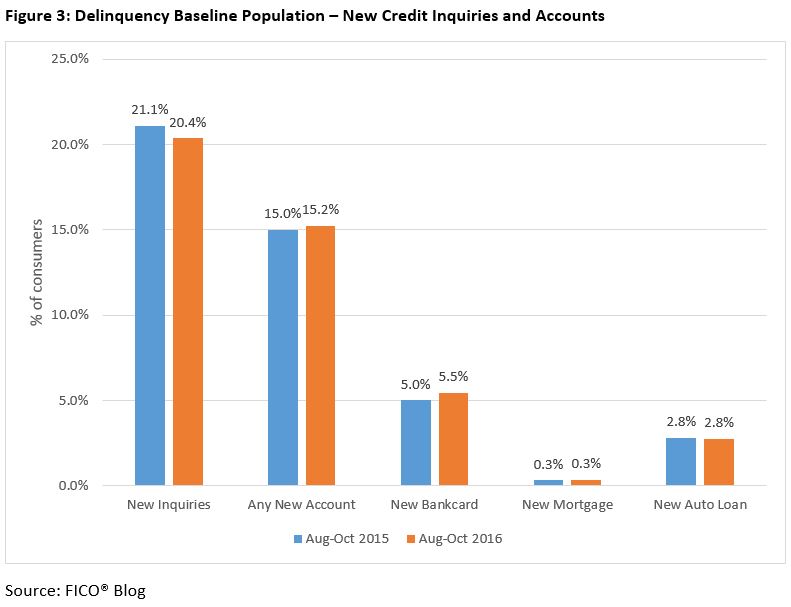

But perhaps the increase was due to other factors (such as less restrictive lending standards), and had nothing to do with the removed delinquencies. So we looked at the inquiry and new account activity for the “delinquency baseline” population (those who had a serious delinquency in 2009-2010 but did not have a delinquency removed between May 2016 and July 2016) as a benchmark for comparison.

In the “delinquency baseline” population, we found that there was actually a small decline in inquiries between 2015 and 2016, and relatively minor changes in new account openings. The figures look quite different from the increases in new credit activity seen in the “delinquency purge” population.

The difference in the year-over-year change in new inquiry rate between “delinquency purge” consumers and “delinquency baseline” consumers suggests an increase in the willingness of the “delinquency purge” population to seek credit, and increased confidence in their ability to get approved. And the data supports that confidence – the increase in new accounts opened is disproportionately large when compared to the increase in inquiries.

As we move further away from the Great Recession, consumers whose credit situation was adversely impacted but who have since righted the ship via responsible use of credit should continue to see marked improvements in their FICO® Score. Based on what we’ve observed from the “delinquency purge” population, their increased creditworthiness comes with expanded interest in and access to credit: a potential win-win for both lenders and consumers.

The post Do Consumers Seek More Credit After Their Score Recovers? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.