Digital engagement offers bank customers a more contextual experience

Blog: Capgemini CTO Blog

The proliferation of technology, 24/7 connectivity, and digitization are revolutionizing customer behavior and taking their expectations regarding service and convenience to a whole other level. As they converge, these factors blur the lines between traditionally dissimilar industries, and customers now want their banking experience to mirror that of other industries.

To rise to this challenge, banks worldwide are racing to introduce customer engagement innovations and investing in digital to improve customer engagement through contextual experiences that are customized and delivered through multiple channels. For example, Lloyds Bank provides a mobile app that pushes out daily offers and deals, allowing customers to apply for new products or set up payments to new and existing payees without authentication. Similarly, Bank of America’s chatbot Erica helps customers manage basic banking needs and acts as a virtual financial advisor. But is this enough?

The challenge

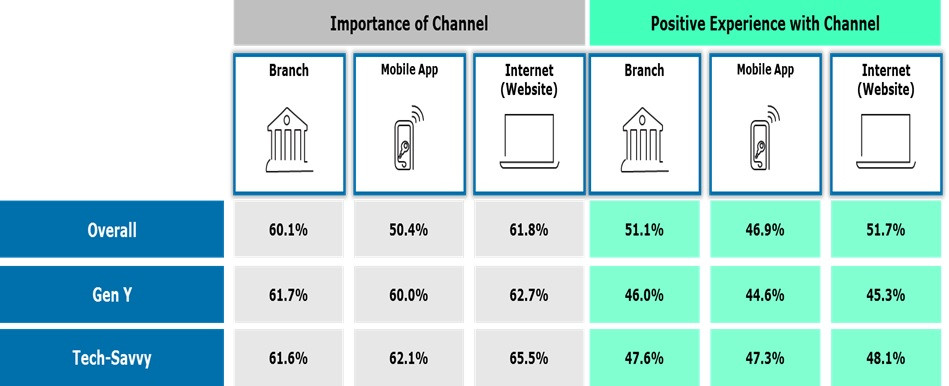

A major challenge for banks is that, regardless of the channel, a substantial percentage of customers have less than desired experience. Capgemini’s World Retail Banking Report 2018 found that a majority of banks still need to improve customer experience and hone their ability to stay ahead of customer expectations. Barely half of the customers we surveyed said that they have had a positive experience across different bank channels despite bank investments into digital (Figure 1). Banks have largely provided services across channels that are merely pretty interfaces for broken back-end processes, and this has stymied customer experience.

Figure 1: Positive Customer Experience by Channel (%), 2018

Sources: Capgemini and Efma, World Retail Banking Report 2018

The importance of digital channels rises sharply when it comes to Gen Y and tech-savvy customers, but positive experience for Gen Y customers dips considerably when compared with the overall customer base. Banks need to remember that customers expect an easy and seamless digital experience – and that if they fail to provide it, they may well lose these customers to new-age digital innovators. Moreover, although many banks are moving from brick-and-mortar to digital, branch as a channel remains very important across all customer segments. Metro Bank, for one, continues to invest in their UK branches in order to provide customers with the right mix of physical and digital experiences, and plans to make these branches digital.

Improving the customer journey

The way banks build and maintain customer relationships is changing rapidly. Because of disruption and new forms of competition, banks need to adapt to changes quickly and create a culture that continually improves customer engagement and experience by making banking easier. Although they have been leveraging artificial intelligence and advanced analytics to understand their customers better, banks still have to proactively deliver personalized products and services that offer a better value proposition.

The banking industry has an unprecedented opportunity to redefine the banking experience and to redefine what banking means for their vast pool of customers. The more seamless banks can make their services, the better. Today, everything revolves around customer experience.

Learn more about how banks are preparing for the future in the World Retail Banking Report 2018.

Leave a Comment

You must be logged in to post a comment.