Data-Driven Strategies: Looking Beyond the Commonplace

Blog: Enterprise Decision Management Blog

Several of my FICO colleagues have written about the benefits of applying data-driven techniques to strategy design within the credit risk space.

The use of historical, structured data in the strategy design process helps to quickly identify the best combinations of variables and thresholds that more precisely segment a certain population. Compared to more traditional judgment-based approaches, strategies constructed following a data-driven methodology typically yield more streamlined segmentations. These segments separate the assessed population into groups that tend to react in a similar manner to the same treatment. This increased accuracy ultimately results in a more effective strategy, an accelerated learning process, and lays the foundation for easier strategy evolution in the future.

The first thing that typically comes to mind when thinking of appropriate areas of your business to apply data-driven strategy design techniques would likely be tactical credit line management (account-level line increases and decreases), early stage collections, or account origination. Not surprisingly, these are also the three areas our clients most commonly ask for assistance in identifying untapped value through the development of data-driven strategies.

However, it’s in FICO DNA to think outside the box. Ultimately, the analytics behind data-driven techniques are potentially applicable to solve any business challenge in the financial services industry. When we were approached by one of our clients in Western Europe seeking assistance to review and enhance their strategic customer management strategies, we adopted a data-driven approach even though this business area has not typically used data-driven strategy design methodology before.

Strategic customer management refers to the automated process used to calculate the maximum monthly amount each individual could spend on additional lending for every single active customer in the organization without adversely impacting foreseeable future performance. This monthly calculation is based primarily on credit risk and affordability. These available monthly funds are then converted into product-level pre-approved limits across all lines of credit. They can be leveraged both proactively (launching marketing campaigns) or reactively (expediting the origination decisioning process when a customer initiates a credit application via any of the available origination channels).

The first thing that caught our attention when we reviewed our client’s existing strategic customer management strategies, was the size of their decision trees. What began as a reasonably-sized strategy had been modified and patched over several years. The overall structure of the strategy had never been changed – only added to. It now existed in the form of an over-sized tree that was difficult to understand, was challenging to measure, and was nearly impossible to properly redevelop.

We spotted the clear opportunity to apply a data-driven methodology to develop a new challenger strategy that could potentially simplify the business as usual structure without sacrificing accuracy or effectiveness.

This organization had been using the FICO TRIAD Customer Manager Credit Facilities for almost a decade to automatically manage their customer-level pre-approved limit process. It wasn’t difficult for them to produce a historical dataset containing an abundant number of customer and product-level variables. These variables contained both observation and performance data appropriate for the customer-level design exercise. Included among those variables was a customer-level risk score developed by FICO which they had been actively using across the entire credit lifecycle for years.

When selecting the historical period for the development dataset, care was taken in order not to incorporate data from periods (months) that could compromise the integrity and reliability of the historical file due to known abnormal events –data issues- or seasonality.

Once the dataset was created and cleansed, the data-driven strategy design process was similar in complexity and duration to more traditional areas of data-driven usage.

The end result of the strategy design exercise was a strategy that spanned less than 100 branches. Our client was thrilled because they had struggled with a decision tree that contained more than 1,900 branches.

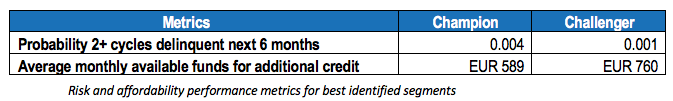

The new challenger strategy not only turned out far smaller and more manageable but also better segmented customers based on their expected risk performance and ability to pay. It uncovered a sizable super-prime sub-population with sensibly better risk, and larger affordability than the best segment previously identified by the business as usual champion strategy.

This lender was able to work with Fair Isaac Advisors to successfully prove that data-driven techniques applied to strategy development can help in many areas: efficiency, effectiveness, improved profitability, and reduced losses.

Data-driven strategies can also help organizations in areas where application of this methodology is less commonplace. Business rules are more easily understood by individuals not familiar with the details of strategic customer management policies such as senior management, internal and external auditors, and regulator representatives. These groups also have a better understanding of the solutions available to them. New strategies are not only simpler and faster, but will continue to evolve and improve while producing better results than the previous overly complicated decision trees.

The post Data-Driven Strategies: Looking Beyond the Commonplace appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.