CECL for Auto Finance – How to get ready for CECL?

Blog: Enterprise Decision Management Blog

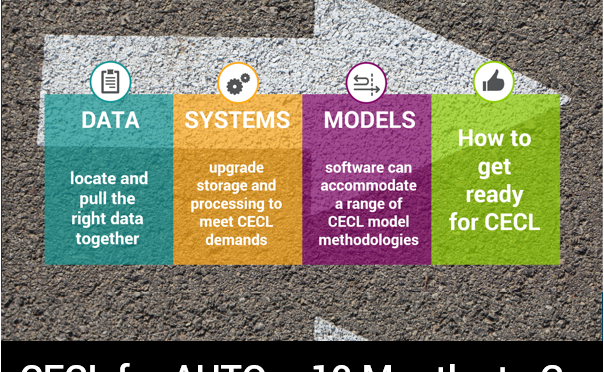

How do you get ready for CECL?

In my last blog post, CECL for Auto Finance – Where Do I Start? I promised to start outlining “10 Requirements for an Effective CECL Software Solution”. These are tips to keep in mind whether you plan to “build” or “buy” a solution. To keep things digestible I’ll spread these out over the next three posts under three headings:

- Ready – What does your organization need to do to prepare for CECL implementation?

- Set – What capabilities does your solution need to have to provide a stable platform?

- Go! – What should your software actually do to help you manage your portfolio under CECL once you have implemented it?

Ready? Let’s find out.

1) How do you get ready for CECL – Data readiness

The best CECL software solutions will help to manage the standard’s vastly expanded data requirements, but it is up to each organization to locate and pull the right data together. For most auto finance providers this requires casting both a broad and deep net to capture all available data relevant for both CECL modelling and ongoing ALLL calculations.

Given the public nature of CECL disclosures, all data used in impairment calculations must be accurate, complete and traceable (think BCBS 239 or SOX standards). If you haven’t retained or purchased historical FICO or behavior scores, now is the time to invest in back-populating so you have a stable, consistent credit risk measurement that you can include in your models and apply to your portfolio going forward. You’ll need to pull account-level data even if you intend to take a segmented approach to model development and application.

2) How do you get ready for CECL – Systems readiness

Software should integrate seamlessly and provide true scalability to manage the additional processing requirements of CECL impairment calculations, which are typically far more intensive than their current US GAAP equivalents. The most complex implementations may require hundreds of calculations in order to produce a single account’s provision figure. This computational explosion reflects the need to incorporate forward-looking information into expected credit loss models that are driven by granular component (PD, EAD, LGD) models typically over multi-year lifetimes. Systems may require significant upgrades in both storage and processing capacity in order to meet ongoing CECL demands. Cloud-based options may be appropriate for organizations whose existing infrastructure cannot scale to meet these requirements.

3) How do you get ready for CECL – Model readiness

Software should flexibly accommodate a range of CECL model methodologies and languages, support parameterization and facilitate testing and development. A common CECL modeling framework may include lifetime PD, EAD and LGD models, which need to be developed and validated both independently and when combined to create lifetime expected credit loss estimates. Forward-looking adjustments must either be incorporated into the relevant component models or reflected as an overlay to the final provision estimates. Parameterizing these models simplifies ongoing model management, reduces operational risk and facilitates “what-if” scenario analysis, key capabilities we will discuss in upcoming posts.

Each of the above preparations should be completed as soon as possible, but planned with a careful eye towards future change. How would you incorporate a new data source if it helped with CECL calculations? How easily could your infrastructure scale if your portfolio grew or changed significantly? What would you do if you chose to (or were forced to) make significant changes to your model design? Plan thoughtfully and flexibly today so the inevitable changes to come in the future can be made easily.

In my next post I will outline the key capabilities and features your CECL solution should provide to ensure you feel in control of your process from beginning to end. Stay tuned!

The post CECL for Auto Finance – How to get ready for CECL? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.