Cash or Credit: A Millennial Story

Blog: Enterprise Decision Management Blog

Last year Millennials surpassed Baby Boomers as the largest generation in the U.S. (Pew Research, 2016). Millennials (those born between 1997-1981) now number 75.4 million, just pipping the Boomers at 74.9 million. The Millennial generation came of age during the Great Recession and some studies from Bankrate and others, have shown they are credit averse, and favor debit cards over credit cards. However, new FICO research points to just the opposite.

Yes, I’d like a Credit Card.

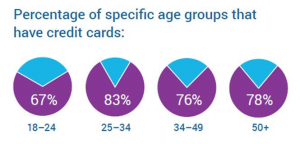

There is no doubt that the Card Act of 2009 reduced the number of credit card carrying adults under the age of 21 which was its intended impact. Indeed, FICO’s research shows that just 64% of Millennials 18-24 have credit cards. However, older Millennials 25-34, now own cards at a higher rate (83%) than Generation X or those 50 and older.

So what do Millennials want in a credit card?

Millennials are particularly cost-conscious when choosing a card. They are most interested in transparency and lower fees and rates. FICO’s research also found that they are more interested than other generational groups in receiving notifications from their card provider on upcoming or missed payments, suspicious account activity and credit limit warnings. This is in contrast to older, wealthier consumers (earning >$100k per year) that are seeking travel or cash-back rewards, no foreign transaction fees and strong security features. Segmentation and analytics are the key for matching the right consumer with the right offer.

Segmentation

FICO has worked with a number of credit card issuers to help them segment and deliver the right analytic offer. Helping to build a base of new Millennial clients is of the first critical step in those efforts. We feel that a single solution that spans both the marketing and origination processes will deliver the best results. By connecting the underwriting and marketing decision, with strong analytic tools, card issuers can get the following benefits:

- ROI forecasting – Before going to market they can simulate the effectiveness of different offers not only from the marketing uptake standpoint, but also from a risk view.

- Customized Offers – With the simulation results, firms can segment customers and pre-approve the most profitable prospects with an tailored offer .

- Continuous Improvement – Using market data to create a continuous feedback loop sharpens both marketing and credit decisions for increased revenue and profits.

To learn more about FICO research into Millennials and Credit Cards download our ebook or to learn more about our Bank Card Solutions visit fico.com

The post Cash or Credit: A Millennial Story appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.