CamundaCon 2024 Day 1: Customer Case Studies

Blog: Column 2

I attended a number of customer case studies, starting with Pascal van Puijvelde, Business Analyst at Rabobank, and his colleague Louwris Wernink, IT Lead Payments, showing how they shifted $5.6M in sales processes (new accounts) to Camunda 8 SaaS, while adhering to regulatory standards. They worked closely with their Camunda Technical Account Manager on designs and modeling, and to set up a Centre of Excellence. They started looking at Camunda in late 2022 when they realized that they required a process orchestrator for their more complex case-mangement style processes. Their old technical stack was being deprecated, and they were looking for an architecture that separated the process orchestration from the front end UI and allowed each to be changed more rapidly, as well as a product that would integrate well with their tech stack. Their first implementation was earlier this year, and they onboarded directly to Camunda 8 SaaS.

They had to learn not just about using Camunda, but also about how BPMN can be used as a link between business requirements and IT implementation.There was some amount of trial and error as they went through their early designs, with both the business and IT having to learn about the new architecture and methods. Banking is highly regulated, so they had a lot of security and privacy concerns that needed to be addressed; this has resulted in them not putting any private data on the SaaS platform, but keeping that on their internal systems and using a reference key. Interestingly, their regulators consider a reference key to be pseudonymous rather than anonymous, so they’re still working through the privacy considerations. DORA (Digital Operations Resiliency Act) comes into effect in 2025 in the EU, and financial institutions such as Rabobank will be subject to stringent guidelines for safeguarding against data breaches and other privacy and security concerns.

They were the first Camunda customer to have a Technical Account Manager, who acts as their conduit to solving Camunda-related problems. They also created a CoE to help standardize their use of Camunda and process orchestration projects. This has really changed the way that they work both in the use of Camunda-focused development sprints, and how this rolls out to the business. Their single biggest benefit from moving to this type of platform is time to market: they signed the contract with Camunda at the end of 2023 and rolled out their first applications earlier this year. Going forward, changes to the UI or the process are much more agile, and new applications can be developed more quickly.

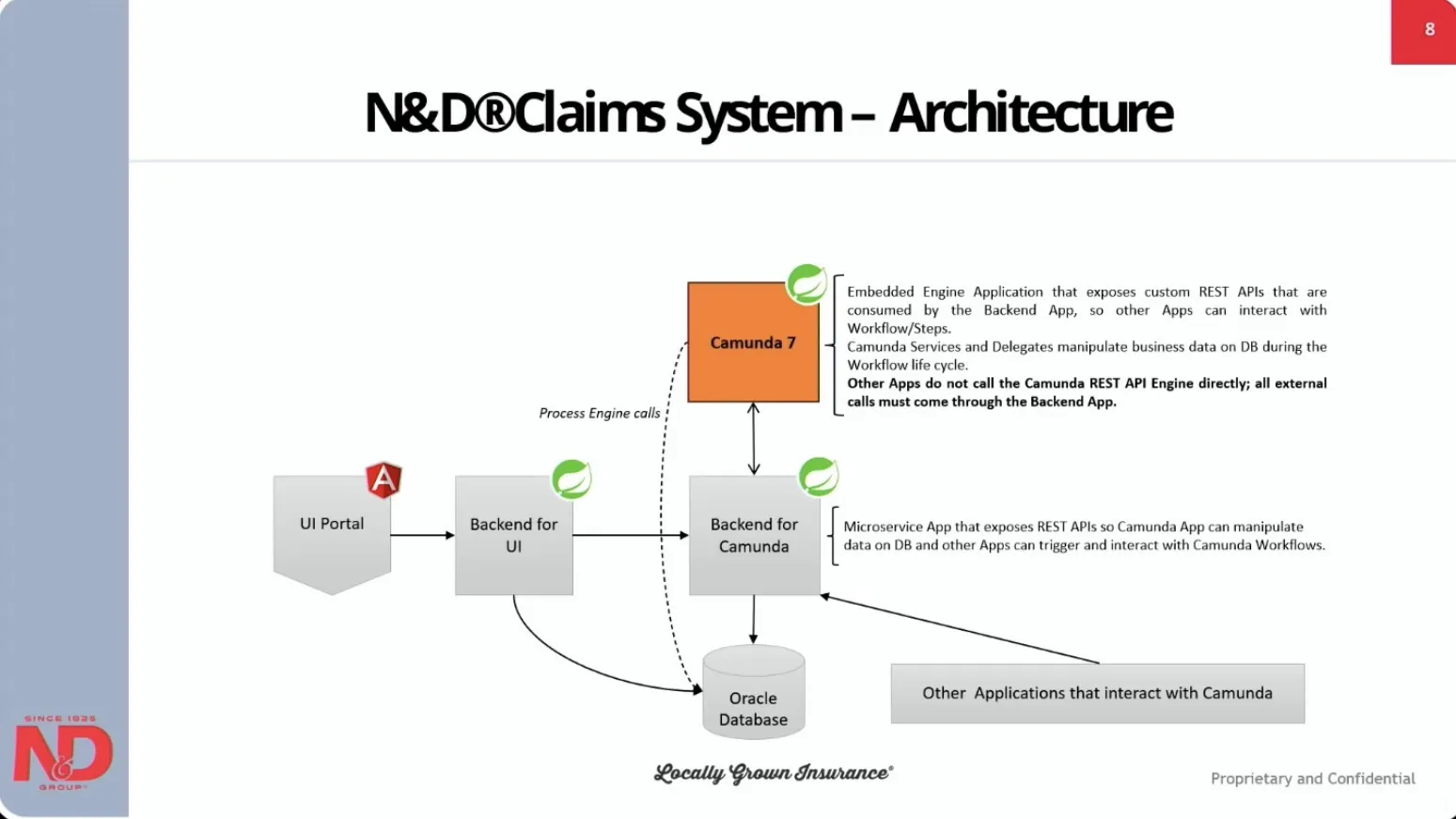

I had a bit of a view of the Norfolk & Dedham insurance case study at the Camunda Day in Toronto earlier this year, and wanted to check back to see how they are progressing with their P&C claims processes. Shashi Ayachitam, IT Director, updated us on how Camunda has become the heart of their new technical architecture, replacing an obsolete workflow tool. When I heard about their projects in March, things were still in the testing phase, although they were nearly ready to deploy claims and were considering other business areas such as underwriting.

N&D customized the Camunda modeler to allow them to include their own business roles (e.g., claims adjuster) and other business data to make modeling faster and more accurate. They made use of the data-rich analytics to provide real-time dashboards and insights that can help to manage operations as well as feed back into process improvement.

In the six months since they deployed claims into production, they’ve cut the time to process claims by 35%, and reduced costs by 30%. Given that they are early in their journey and can likely still do a lot of fine-tuning, these are fairly significant improvements.

They are interested in Camunda’s new roadmap that includes RPA and AI, since they can make use of both of those technologies to improve their operations. They’re on Camunda 7 on premise, and haven’t started planning for migration to Camunda 8 although Camunda has announced end of life for V7 by 2030 with a gradual phase-out.

The last customer breakout that I attended was with Yash Agarwal and Rishabh Surana of Intuit, describing how they incorporate Camunda into their QuickBooks mid-market accounting product. In addition to my work consulting in financial services, I’m also a former QuickBooks user for my own business, and I was interested to see how they are using it for actions such as approvals, reminders, notifications, and triggers within the product.

They went from simple forms-based workflows triggered by a single condition, to visual process models that allow for branching with multiple conditions and actions. An example that they showed was reminders to customers for near/overdue invoices, which allows Quickbooks clients to receive their payments earlier and potentially with a greater success rate. They still provide a template-based design for ease of use by non-developers, but dynamically generate BPMN process models at runtime.

They found some key bottlenecks with their Camunda 7 implementation: the external task pattern is not particularly scalable, and large numbers of timers are problematic due to their reliance on asynchronous jobs.

This led them to implement the equivalent functionality outside Camunda to achieve the performance required. They started experimenting with Camunda 8 to see if they could bypass some of these bottlenecks, and found out that tweaking the configuration allowed them to reach the low latency levels that they required for the external task pattern, as well as support the large numbers of timers that they required.

They showed a list of the issues such as these latency problems that they have resolved by working together with the Camunda team, as well as some of the issues still being resolved. A realistic look at the technical issues around an implementation, and the performance improvements that can be experienced when migrating from Camunda 7 to 8. They evaluated other options when they started their v8 experiments, but found that the options that had equivalent performance didn’t have the same level of functional sophistication.

Interesting set of customer case studies. I’m off to the industry analyst session for most of the rest of the day, although may be back for the SAP integration session at the end of the afternoon. You’ll be able to see the recordings of all of these sessions by some time next week.