Blockchain in Fintech: 5 Financial Services Inefficiencies that Blockchain Can Resolve

Blog: NASSCOM Official Blog

Blockchain technology has been the talk of the town for a few years now. Blockchain technology is indeed one of the most disruptive technologies of the 21st century, a technology that uses –encoded, decentralized, immutable, and a distributed ledger that has the capacity of making every centralized process in the world – transparent, secure, and decentralized.

The technology first became popular due to its successful implementation for cryptocurrencies like Bitcoin. However, over the years the blockchain has found its use case almost in every industry from manufacturing, to supply chain to financial services, etc.

According to a report from Markets & Markets, the global blockchain market is forecasted to grow from 3 billion US dollars in 2020 to around 39 billion US dollars by 2025, at a huge CAGR of 67.3% during the period 2020–2025! This indeed hints at the phenomenal scope that this technology holds and the market inefficiencies that it promises to resolve.

Among all other industries, Blockchain has specific mention when it comes to the financial services industry as the technology possesses the capability of transforming the industry like never before. From reducing operational costs to faster & safer execution of financial transactions to improved transparency to operational efficiency, and other benefits – blockchain technology promises to bring all of these and many more the industry which has for decades been hampered by many such bottlenecks.

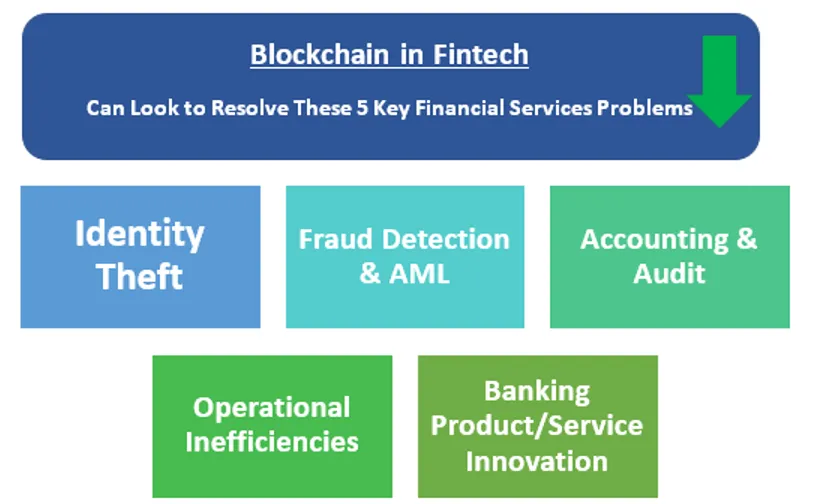

Let us look deeper into how blockchain can resolve some of the Key Inefficiencies of the financial services industry: Reimaging the Financial Services world with Blockchain!

5 Financial Services Inefficiencies that Blockchain Can Resolve:

1. Identity Theft

Identity theft has long been a critical issue with the financial services industry. For the financial services industry, having a secure authentication process is no longer a god to have, but is a must-have rather. Further, multi-factor authentication has become extremely important for organizations, to combat identity frauds.

- Blockchain technology can eliminate the painstaking issue of attestation and identity fraud in financial services by providing a decentralized, distributed ledger to record banking or financial services identities and transactions.

- The technology promises to have the potential to enable two parties that do not know each other, do not trust each other, etc. to easily perform secure transactions over the decentralized, immutable network without the need of any financial intermediaries to verify the identity of the parties and with zero % identity theft probability!

- Secure Digital Identities can become a real thing and can be easily used for transactions over the blockchain network.

2. Fraud Detection & AML

Not just identity theft, but financial fraud at an overall level and money laundering have been one of the key impediments of the growth of the industry for decades now. But a cutting-edge technology called blockchain could provide the fraud prevention capabilities the financial services industry has been looking for.

- Many things complicate financial transactions ranging from the need for collaterals, the exchange between multiple parties, settlement time, currency differences, etc. With blockchain, information can be shared in real-time, and the decentralized digital ledger can only be updated when all parties agree, reducing the fraud propensity.

- Smart Contracts that can be enabled with blockchain can revolutionize the fraud detection scenario in the financial services industry. Smart contracts allow all parties of a financial transaction to create if / then contracts in which one step of the transaction process cannot be fulfilled until the one before it has been authenticated completely, again reducing the propensity of financial frauds and money-laundering in a big way.

3. Accounting & Auditing

Efficient and fool-proof record keeping, accounting, and auditing have been another set of hindrances for the financial services industry for many years now.

Blockchain Technology provides disruptive new methods using distributed ledgers secured by cryptography that can make audit and financial reporting transparent and occurring in real-time, totally eliminating the need for record-keeping, book-keeping on the hindsight.

Blockchain technology has the potential to transform completely the nature of accounting and auditing in today’s financial services world – completely automating the processes and that too in compliance with the regulatory requirements.

4. The Cost & The Speed of Transactions

Blockchain has the potential to revolutionize the operational efficiency of the financial services industry like nothing else. For years, the industry has been facing huge operational costs and sluggish timelines of transaction settlements.

Blockchain is such a disruptive technology that eliminates the back-office expenses, making the middlemen extinct, by bringing all transactions over one distributed digital ledger is always updated in real-time, saving millions of dollars in back-office expenses alone across the globe.

By deploying blockchain systems, banks could save as much as $20 billion on back-office costs while also securing their clients’ data and financial assets in a big way.

Also, blockchain magnifies the speed of transactions miraculously, especially when it comes to cross-border transactions which can otherwise take days in settlements. Blockchain removes multiples ledgers, multiple intermediaries, multiple borders in international transactions which can take a lot of time, cost, and can fail at any time.

Many blockchain networks using Bitcoins promise a very less cross-border transaction settlement time – sometimes even less than like 10 minutes which is indeed phenomenal compared to 10-15 days settlement time in some erstwhile methods.

5. Banking product & service value Innovation

Bankers today are dying to create product or service value innovation or in other words, innovative ways to create and give enhanced value to their customers.

Blockchain solves this perennial problem of the financial services industry by helping many bankers use this chain of blocks to create many innovative valuable offerings for their banking customers by giving them the option to securely exchange many other financial assets too through the blockchain network. Digital financial assets or also known as crypto assets exchange is one of the most valuable service offering that blockchain has provided.

According to a recent study by EY, in 2009, there was only one crypto asset in the market — bitcoin. Today, more than 1,500 crypto-assets exist, with many more created monthly. This is a remarkable value innovation for the industry provided by the blockchain technology.

The Road Ahead:

Blockchain technology can certainly reduce setbacks, disputes, and chaos in many facets of the financial services industry. Blockchain clearly has the potential to solve some of the key problems of the financial services industry that have been hampering the industry for long.

In a 2018 survey of PWC of around 600 executives across locations, close to 84% said their organizations have at least some involvement with blockchain technology – ranging from research to building proofs of concept, to pilots, etc. The whole world is talking about blockchain today and the race looks growing even more competitive by each passing day.

Many global banks like JP Morgan Chase, Bank of America, and Goldman Sachs are already involved in blockchain technology for their operational activity. Indian FS players are not left behind either. Many Indian financial services industry players like ICICI Bank, Bajaj Allianz, Axis Bank, IndusInd Bank, etc. have started experimenting and deploying blockchain solutions in some way or the other.

We continue to see banks, brokerages, insurers, regulators, and others in the financial services industry actively looking for ways to deploy the benefits of blockchain. The journey looks just begun.

Stay tuned for more on Blockchain in Financial Services and much more. You can also comment in the box below or can reach me here.

References:

https://www.marketsandmarkets.com/

https://www.grandviewresearch.com/

https://www.pwc.com/gx/en/industries/technology/blockchain/blockchain-in-business.html

https://www.ibm.com/blogs/blockchain

https://www.entefy.com/blog/post

NASSCOM Insights

Deloitte Consulting

KPMG Research

IBM Blockchain

The post Blockchain in Fintech: 5 Financial Services Inefficiencies that Blockchain Can Resolve appeared first on NASSCOM Community |The Official Community of Indian IT Industry.