Banking Fraud Prevention: System Silos Create Gaps for Criminals

Blog: Bizagi Blog

84% of companies worldwide experienced a fraud incident last year – that’s an alarmingly high rate. The banking industry is particularly at risk, with the typical organization losing 5% of revenue to fraud each year. And it’s not just income that’s damaged, but brand and reputation can fall to pieces. Something needs to be done to monitor and control fraudulent activity in banking.

The rise of mobile and open banking has seen fraud become more prevalent. As technology makes it easier for professionals and consumers to manage their money, it also makes it easier for criminals to take advantage of vulnerabilities in the system.

Banks particularly struggle with fraud due to the way that their infrastructure has built up over the years. The siloed storage of information has made it hard to (literally) connect the dots and detect fraudulent patterns of behavior.

Connect disparate systems to detect fraudulent activity

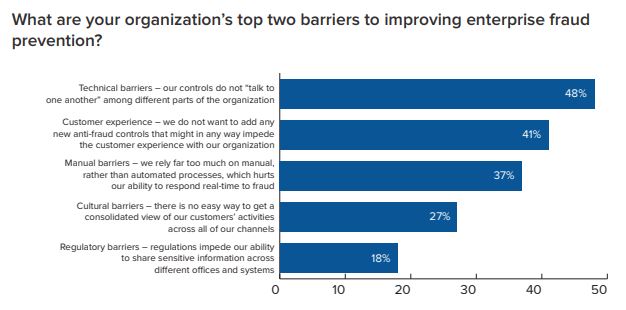

The inability of controls to ‘talk to one another’ among different parts of the organization is a top barrier to improving fraud prevention, according to a 2018 survey by iSMG Information Security. Businesses need to develop an infrastructure that offers a secure, holistic view across all their information if they want to detect patterns that may indicate fraudulent behavior.

(Image from iSMG)

“To reduce losses, banks and capital market firms must improve their defenses, which means upgrading disparate transaction systems and piecemeal fraud detection systems,” reports Capgemini.

“The increasing sophistication of the perpetrators of fraud is forcing banks to carefully balance fraud identification and loss prevention against the quality of the customer-service experience.”

Another problem is that today’s fraud schemes are too sophisticated and evolve too quickly to keep change of pace. In fact, iSMG’s survey found that it was rated the top vulnerability in banks’ fraud defenses. So, any fraud prevention technology put in place needs to be able to adapt and update at the same rate.

The solution is an agile platform that allows you to develop processes and integrate applications in fast sprints so that you don’t get left behind by cunning fraudsters. A flexible, agile system will also allow you to connect your existing IT systems in a secure way. This provides visibility over all your information and ensures tighter control on end-to-end processes.

Defend confidential information

It’s not just monetary theft that’s a concern. Incidents of identity fraud and intellectual property (IP) are rapidly increasing. For the first time in the Kroll Global Fraud and Risk Report’s 10-year history, information theft, loss, or attack was the most prevalent type of fraud experienced, cited by 29% of respondents, up 5% from the previous year.

You no doubt read about cyber-attack threats and ransomware in the news in the past year. The likes of WannaCry, which infected 400,000 computers and severely effected Swiss banks, and Petya snatched headlines and made people aware of data vulnerability. Four in 10 executives told Kroll that their companies had been impacted by a virus or worm attack and 27% had suffered a data breach.

MIT has warned that cloud providers which host corporate data are now at risk and hackers could weaponize AI along with machine learning to lead phishing attacks and spread malware at an alarming rate. Scary stuff.

Protect your brand and assets

All these threats mean that people are more aware of the vulnerabilities in banking. So customers need to be reassured that their money and information has sufficient protection.

If you are repeatedly falling victim to fraudsters, it will have an impact on your customer retention and satisfaction. Banks need to instil confidence in their customers that their services cannot be infiltrated by criminals. Carnegie Mellon University has proved that there is a clear relationship between security breaches and loss of customer trust and loyalty.

The most recent YouGov BrandIndex for US banks shows that Chase is rated as the best brand. J.P. Morgan Chase is reported to have spent half a billion dollars on their cybersecurity in a bid to “maintain the security of its financial, accounting, technology, data processing and other operating systems and facilities.” It’s expensive but will help to retain money and reputation in the long run. They have acknowledged that fraud is a problem and are tackling it head-on.

If banks want to ensure that their brand remains intact, they need to identify risks with fraud monitoring tools and put real-time integration in place.

Adhere to compliance to ensure security standards are met

As threats increase, regulatory standards tighten. Banks must perform appropriate checks during the onboarding phase and continue to monitor behavior throughout the customer journey. And it’s not just external threats – insiders and ex-employees pose the greatest threat, so ensure that you have stringent internal regulations in place too.

By 2020, credit, debit and prepaid general-purpose payment card fraud worldwide is expected to increase to $35.54 billion. Digital processes can help to diminish these numbers by keeping criminals out and prevent any internal human error or intentional misconduct. Automation can help to enforce a central audit system to record data and actions and help you to prove compliance across your channels.

You can prepare for fraud detection from the outset by using DPA to help you carry out due diligence and Know Your Customer (KYC). If you use the correct tools and analytics during the onboarding phase for customer identification and authentication, you can complete a thorough risk assessment. The signs are often there, you just need to technology to identify them, such as real-time monitoring and other anti-fraud measures.

If you would like to see fraud control using Bizagi in action, watch our Mortgage Loan Demo on-demand on BrightTalk.

Skip to 25:12 for information on how to enable better fraud detection during the customer loans process. Bizagi’s machine learning capability can be used to predict whether cases need to be sent to fraud preventions professionals or not.

Don’t become another statistic. Ensure that your disparate systems and data sources are connected with a process layer helps you to gain an agnostic view of client information and activity. This will help you to remain compliant and makes it easier to detect fraudulent activity. You can even anticipate and prevent it from happening, potentially saving any reputational damage and millions in lost revenue.

The post Banking Fraud Prevention: System Silos Create Gaps for Criminals appeared first on Bizagi Blog – Ideas for Delivering Digital Transformation.

Leave a Comment

You must be logged in to post a comment.