Accounting Problems Solved by Process Automation

Blog: iDatix Blog

If your Accounts Payable department is still relying on manual processes, kick off that rock you’ve been living under.

With manual processes, your accounting and finance team spends a large portion of their time looking for information, analyzing and formatting documents, routing them for review and approvals and finally, filing and storying it all.

By automating accounting processes, your organization will achieve a rapid return on investment. How? Let’s dig a little deeper.

What is Process Automation?

Simply put, automation streamlines your business processes.

In a typical AP environment, the department’s main job is to approve, process and pay outstanding invoices from vendors and suppliers. The route is straightforward, but the margin for error is high. Lost invoices, human error during data entry and duplicate invoices lead to high costs for your organization.

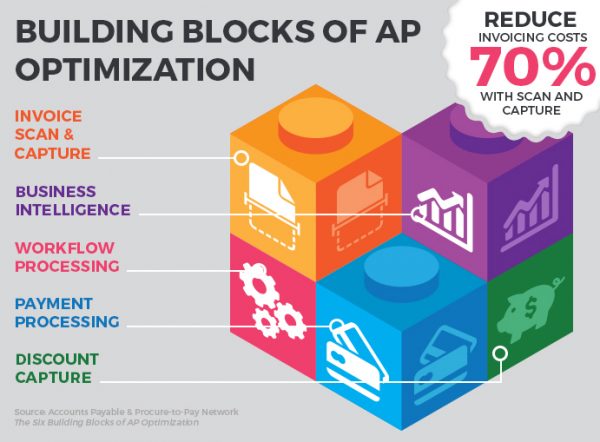

Automation helps your AP department create and follow a streamlined practice for the way your business runs. Some of the most common process solutions include the use of document management, workflow automation and data capture for invoice scanning and capture; business intelligence; workflow processing; payment processing; and discount capture. Let’s explore how these tools can solve common issues in your accounting department.

5 Common Accounting Issues Solved by Process Automation

-

Lengthy Approval and Payment Cycles

One of the most pressing responsibilities of finance and accounting professionals is to verify thousands of account balances and invoices. In doing so, they must compare myriad sources of data, such as bank statements, invoices, purchase orders and more.

DocuPhase’s Workflow Automation core solves for this by allowing your business to create and define a single process for how work gets done. The software houses and tracks documents, and then assigns tasks once all of the information needed is available. This provides visibility into your business processes and lets the AP environment know where documents lie in the approval process – speeding up the approval process.

-

Multi-Format and Decentralized Documents

Accounting departments require an incredibly high level of information exchange. Invoices come in from different suppliers in many different layouts and delivery formats – mail, fax, email, EDI, etc. And while the documents may be stored in a way that makes sense to each employee, they’re not in a centralized repository where other users can easily access them.

Document Management software makes all documents and information in your organization available at the fingertips of the employees who need it, at the exact moment they need it. It also diminishes the high cost of paper storage – an average of $1,400 per file cabinet, according to the AP P2P Network. This turns a simple efficiency initiative into revenue growth.

-

Missed Vendor Discounts and Late Penalties

Slow manual processes increase the likelihood of your organization owing late payment fees and diminish your organization’s ability to earn financial benefits such as early payments discounts.

Luckily, process automation and productivity are best friends. Automated processes allow your business to improve efficiency, reduce cycle time and eliminate redundancy by controlling your business processes.

-

Costly Payment Processing

Accounts Payable professionals understand the pain of manual invoice processing all too well. Not only is it inefficient and error-prone, it’s expensive! According to a study by The Aberdeen Group, the average cost to process an invoice is $6.29. Now multiple that by the thousands of invoices that your organization receives per month.

According to the same study, organizations with best-in-class AP automation software only pay $3.34 to process an invoice. Process automation eliminates the manual tasks that are withholding your finance department from using their time more productively. And you know the saying… Time is money! This gives your employees the opportunity to redirect their efforts toward more strategic tasks.

-

Inefficient Data Capture

Ensuring that all data entered into your business is accurate, relevant, up-to-date and easy to decipher is critical to running a successful business, so corporations that deal with volumes of paper files and records need to have an accurate data entry process.

DocuPhase’s electronic Data Capture uses OCR to not only convert documents into business-ready data, but to also validate the paperwork against other data that’s already stored in your system.

Automation results in greater control and visibility of the data, and frees professionals from the enormous amount of time they spend collecting, organizing and verifying information. To learn how DocuPhase’s accounting automation tools can help your AP department, schedule a test drive.

The post Accounting Problems Solved by Process Automation appeared first on DocuPhase.

Leave a Comment

You must be logged in to post a comment.