5 Reasons Cyber Scoring Is the Next Big Idea for Credit Unions

Blog: Enterprise Decision Management Blog

The greatest risk to credit unions and CUSOs today is the loss of your members’ trust and financial safety. Can your institution survive a cyber breach?

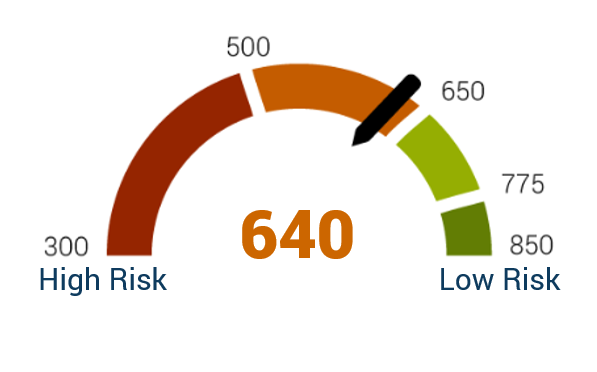

Understanding your cyber risk is a critical part of protecting yourself and your members. That’s why we launched the FICO® Enterprise Security Score last year. And now, our cyber score has been selected as one of 5 big ideas to be presented at the National Association of Credit Union Service Organizations (NACUSO) 2017 Network Conference “Next Big Idea Competition.”

Why is cyber scoring the next big idea for credit unions?

- Fraud/cybersecurity is the top priority for credit union CEOs and, by extension, CUSOs.

- Today’s breach risk measurements are inadequate and inaccurate. They’re manual rather than scalable, judgmental rather than empirical, point-in-time rather than predictive.

- ESS is rapidly deployed. You don’t install software, you just throw a switch.

- ESS is multi-tenant, so CUSOs can rapidly provide the service to any number of credit unions.

- ESS comes from FICO, the gold standard in compliant scoring solutions. We understand better than anyone what regulators are looking for when they look at analytics solutions and how they’re used.

How It Works

FICO® Enterprise Security Score uses advanced analytical techniques including machine learning and artificial intelligence to quantify the likelihood that an organization will suffer a significant breach event during the next 12 months. If you thought AI was just for the big banks, think again.

The score is strictly empirical. Our analytics consider a wide range of inputs gleaned from billions of external data points that are continually monitored at internet-scale, as well as commercially compiled data from leading threat reporting organizations.

In addition to the score, ESS provides a prioritized, detailed list of specific “next steps” that you can use to remedy risk exposure.

FICO’s ESS is unique in its empirical approach, the predictive and forward-looking objective outcome, and the insights provided to the user for remediation and management. It’s also an excellent tool for vendor management.

Is cyber scoring the next big idea for credit unions? We think so. We’ll have 7 minutes to convince the industry leaders who are judging NACUSO’s version of Shark Tank!

NACUSO’s 2017 Network Conference “Next Big Idea Competition” will take place on April 12 at the Disney Yacht & Beach Club Resort Convention Center in Lake Buena Vista, Florida. If you’re attending, come root for us!

The post 5 Reasons Cyber Scoring Is the Next Big Idea for Credit Unions appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.