18 months later…

Blog: BP3 Blog

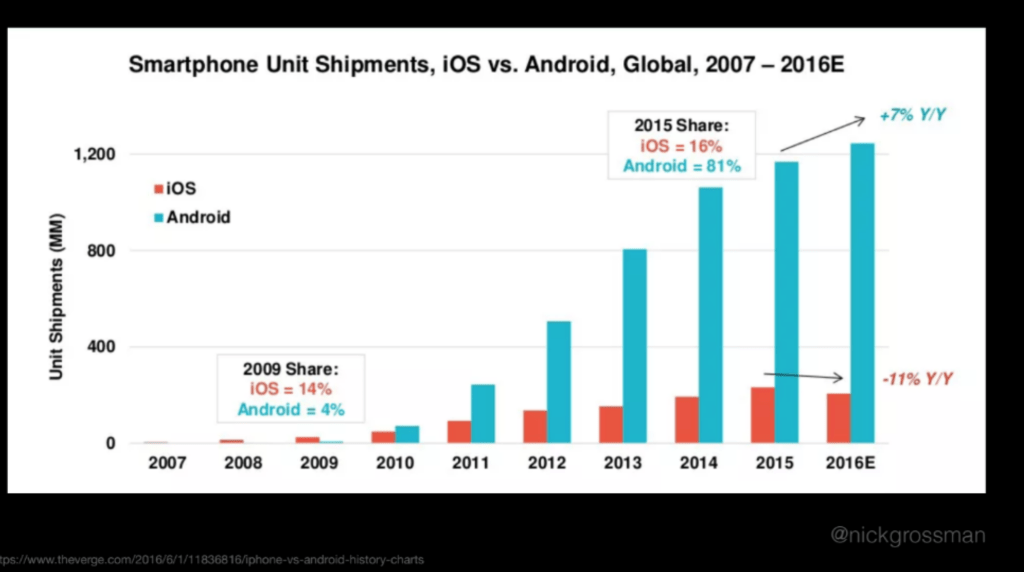

Seems like just yesterday, but it was 18 months ago (approximately) when Fred Wilson’s blog contained this chart:

Of course, it isn’t wrong, though it only goes through 2016… which is odd for commentary happening in 2019, to not use current data or at least 2017 or 18 data… And the implication was that Apple was the “hare” and Android was the “tortoise”… And there was a lot of talk about this being the moment for the “turn” where Android starts to eat Apple’s lunch and Apple shrinks to the point that it is more like the Mac vs. PC. Both then and now, I think the analogy is apt, but backwards – Apple is the tortoise. Meanwhile in 2019, let’s take a look at how market share ended up – it sure looks like a 22% handle rather than an 16% handle… (with an estimate of a decline into 2016 that didn’t really happen).

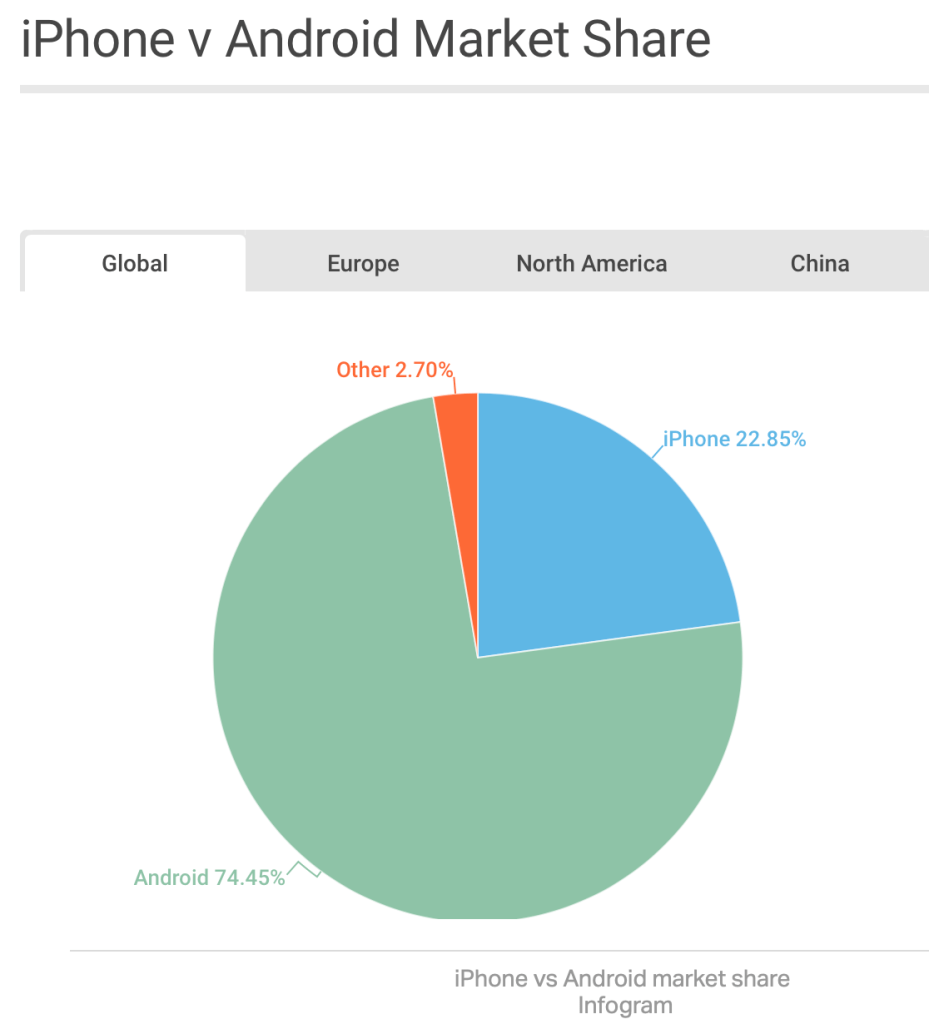

Meanwhile, 2019 numbers from Statcounter:

So, 4 years later, Apple’s market share has not declined, it has held steady – no, increased – in the intervening years 2016, 2017, 2018, to 2019. In the comments on the AVC blog I wrote:

Just seems to me we have the tortoise and the hare backwards in this analogy. I completely respect the philosophical debate and both sides of it (and i’ve benefited from both types of ecosystems, and from specifically both of these), but so far it looks like two players are winning. that’s hardly bad news, and the jury is still out on what it means for the future. But if Apple wanted to play the “hare” they would have licensed iOS to all the OEMs to manufacture

I still think that’s the right take. Apple’s strategy was the tortoise – build the hardware, the machinery to make the hardware, the production methods as well, and then build the software, the developer tools, the operating system, the initial applications, the all-new touch paradigms and User Interface idioms and form factors – and only then release this new product into market. The “fast” way would have been to OEM this new software to a variety of OEMs and let the OEMs drive the device cost to zero margin. And if you watch the chart of Android adoption, that’s what they did.

Meanwhile, Apple invested in the long-run: their own impressive chip designs (The A-series), the capacity of partners to produce their high quality screens, the equipment and software to do facial recognition, the software and hardware to do fingerprint ID so quickly you barely notice it is happening, and into all sorts of camera advancements that are partly hardware and partly software.

With the latest iOS release, we even see articles like “After iOS 14, there’s almost no reason to buy an Android phone anymore“, written with the perspective that all the remaining features that Android users bragged about over iOS users had been captures:

- Widget parity achieved

- Home Screen declutter achieved

- More choices for default apps (Mail and Browser, in particular)

- Launch a shortcut

- Emoji search (yes really)

- better messaging

Leading Daring Fireball’s Jon Gruber to write:

[…] it occurs to me that there’s simply an enthusiasm gap.

Do you get the sense that Google, company-wide, is all that interested in Android? I don’t. […]

Apple, institutionally, is as attentive to the iPhone and iOS as it has ever been. I think Google, institutionally, is bored with Android.

And I can’t help but feel that way, too. The challenge, I think, for Google is that Android was always defensive in their strategy – to prevent their great cloud services from being locked out by device vendors (although, that was borrowing a future problem that didn’t exist at the time they launched Android’s copy of iPhone form factors). Now that they’ve accomplished that, making Android 10x better doesn’t defend Google’s dominant services 10x better. It defends them about.. the same. Like, 70% market share same, so that’s pretty good. The incentive to keep the urgency on just may not be there.

Meanwhile, for Apple, the iPhone and iOS are the lifeblood of the company, and drive not only device sales, but also future services consumers, and halo effects into other products like the watch, iPad, and Mac.

Another comment was that they would never buy the stock, but it is up something like over 100% since that comment was published. That’s not a reason to buy the stock going forward, mind you, and I’m not one that anyone should take investing advice from, but rumors of Apple’s or iOS’ demise are greatly exaggerated.

I appreciate Fred Wilson’s perspective on open versus closed, but I think each market is a case of “open in what ways?” – and if you’re open in the ways that matter, then you’re good. In the case of Apple, that means:

- it is very easy to build apps for it for developers.

- it is very easy to buy or download apps for it for consumers- with very little risk of malware or other bad outcomes.

- it can be used across many (all?) telecom carriers of interest

- it can be purchased through many retail outlets

- it comes in (some) variety of form factors and colors.

What is the additional “open” that has value for the Android ecosystem? The main benefit appears to be to consumers for receiving commodity phones at lower prices. That’s a real benefit. But that benefit does not accrue as much economic benefit as Apple’s approach.

Apple and Android both have a great future in front of them – just don’t expect either to knock the other one off their perch, they’re both big enough ecosystems that it is hard to picture either one failing quickly.

The post 18 months later… appeared first on BP3.

Leave a Comment

You must be logged in to post a comment.