3 Processes Ripe for Automation in Financial Services

Blog: Bizagi Blog

The

financial services industry is experiencing significant forces of change.

FinTech is redefining the customer experience, and regulatory pressure has

opened a $4billion RegTech Market.

The emergence of new FinTech players makes it possible for the new

entrants to “act like a bank” without the end-to-end processing capability (or

regulatory constraints) that incumbent players have.

Many incumbents are having to respond with automation in financial services by investing in technology transformation to enable the customer experience and protect their banking services. Bizagi offers integration capabilities, and the ability to simplify complex processes – a combination that can give them a true competitive advantage against new FinTech players.

Refining the customer experience will be the main catalyst for technology that drives core transformation and automation. But fraud prevention and adhering to regulatory frameworks will also be important accelerators in the digital transformation journey. Read on to find out how these three areas, in particular, can be automated to help financial services digitally transform.

1 – Customer

experience

Right from the

beginning of financial institutions’ relationship with the customer, it’s

important to define the relationship with exemplary customer service. So, the

onboarding process is an important place to start. Yet only 55% of banks and credit unions have a “structured” onboarding process.

Digital capabilities for customers have moved from an advantageous convenience to a complete necessity for financial institutions. However, most financial organizations don’t permit customers to open a new account entirely online or on a mobile device. And branch-based ID verification and/or signatures or supporting documentation are required at the majority of organizations.

A poor onboarding experience can cut short your relationship

with a customer. Conversely, when you get these moments right, you create the

basis for long (and profitable) relationships. Keep in mind that your internal customers (i.e. employees) expect the

same user-friendly experience.

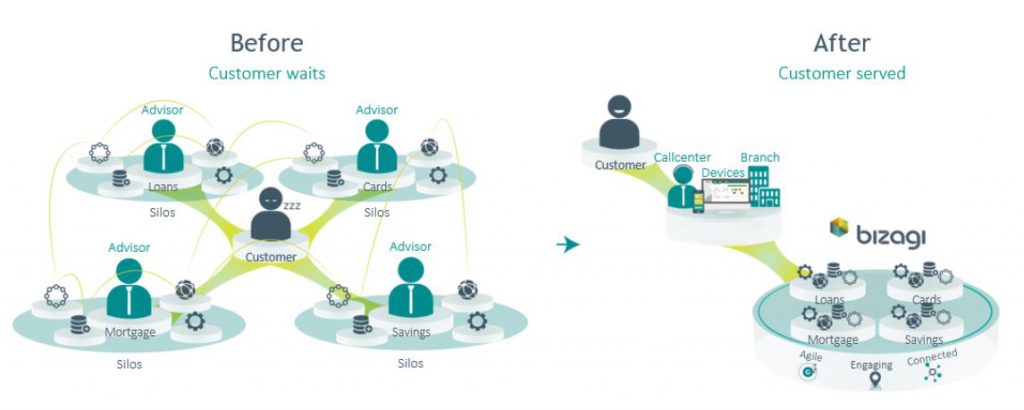

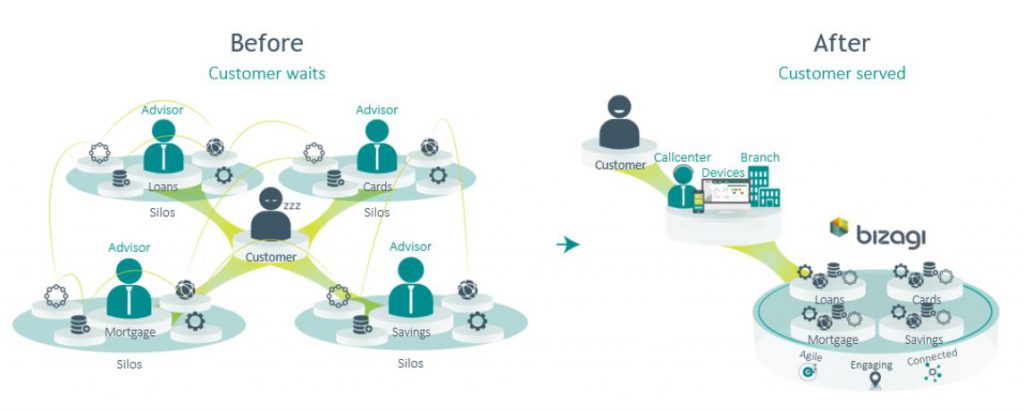

Bizagi connects the myriad datastores and technology across your organization. With a single place to view real-time information, you can create a common starting point from which to develop agile processes. Once you’re connected, you can be more agile. And that’s when you start engaging people inside and outside your business.

Citizens Bank used Bizagi to connect its disparate systems and orchestrate data to improve its commercial lending process and customer onboarding. Coordinated data and a 360-degree view of customer information has helped employees to pass responses to customers in real-time, and accelerated the customer onboarding time from 59 days to just 9 days.

2 – Fraud prevention

According to PwC’s Global Economic Crime and Fraud Survey, 49% of

global organizations report having been a victim of fraud and financial crime. Over

half of victims recover less than 25% of fraud losses, demonstrating that fraud

prevention is key.

Banks particularly struggle with fraud due to the way that their infrastructure has built up

over the years. The siloed storage of information has made it hard to

(literally) connect the dots and detect fraudulent patterns of behavior.

The inability of

controls to ‘talk to one another’ among different parts of the organization is

a top barrier to improving fraud prevention, according to a survey by iSMG Information Security. Businesses need to develop an infrastructure that offers a secure,

holistic view across all their information if they want to detect patterns that

may indicate fraudulent behavior.

Suspicious activity

reporting (commonly called SARS) is a great fraud prevention method and can be deployed

using process automation to make it even more effective. If someone passes a check,

they deem potentially fraudulent, by law they must fill out and file a report

with local authorities i.e. a SARS report. An intelligent automation platform

can speed up that process by auto-populating and submitting the form electronically

and leave an audit trail to help report it to the authorities and process it

across departments.

Intelligent automation in financial services can also help with your case management and understanding the history of account claims to look for patterns for insurance fraud, e.g. false claims, organized crime, overvaluations. Insurance companies can then link analysis to find patterns in their claims data to help reduce fraud, avoid risks, and identify crime.

Only 11% of banking risk leaders felt highly confident in managing financial crime’s impact, according to Accenture. Bizagi provides best practice processes to manage fraud from detection to resolution. Bizagi offers the collaboration, automation, and integration features needed to improve the process. Bizagi allows cross-department cooperation and information sharing that helps reduce fraud.

3 – Regulatory

framework

Regulations impact essentially every part of financial institutions. Their marketing materials, vendor relationships, trading applications, and customer contracts are all subject to tough scrutiny by regulators. All roads at a financial institution lead back to compliance, yet two-thirds of banks do not have an overall data governance framework, according to PWC.

Financial institutions tend to handle regulatory requirements in a siloed and disparate manner. Different documents that are required to achieve regulation of various items will often be located in different systems or locations. The process is not viewable end-to-end and is certainly not trackable.

It doesn’t have to be that hard. With Bizagi, the process could be unified into one workflow with automated features to save time and ensure compliance. For example, an easy win is to automate handoffs between teams into and out of the legal and compliance department. Automating the process through a system that can act as a single source of information and connect all departments involved. This helps provide transparency, efficiently and leave an automated audit-trail, which all help to ensure compliance.

For example, the loan origination process, which has multiple touchpoints and approvers, can be difficult to streamline. Loan authorization may be carried out on a different platform to other products, such as cards, mortgages, and savings – all of which could present data that affects the outcome of the loan. By introducing a Bizagi to the process, financial institutions can gain a more holistic view of their operations and processes and ensure compliance.

Old Mutual

Bank had 11 disconnected systems with no single view of the

customer. This created an unnecessarily long onboarding process as staff relied

on individually coded variables to approve the customer data in a compliant

manner. By

using Bizagi to introduce Digital Process Automation through a simplified data

model, they created a compliant way of approving loans and reduced their

customer onboarding time ten-fold.

Having clear documentation of processes to identify all material aggregate risks, and how those risks are being managed while automating manual tasks within the processes is a great way to ensure that regulatory frameworks are properly laid out and executed.

If you would like to find out more about how Bizagi can help you provide best-in-class experiences with automation in financial services, download our whitepaper, ‘Harnessing Digital Process Automation to Drive Transformation in Financial Services.’

The post 3 Processes Ripe for Automation in Financial Services appeared first on Bizagi Blog – Ideas for Delivering Digital Transformation.

Leave a Comment

You must be logged in to post a comment.